CGTN Think Tank

Introduction

The Forum on China-Africa Cooperation (FOCAC), established in 2000, is one of the most important mechanisms for China-Africa cooperation. Since 2000, seven successful FOCAC events have been held, of which the third in 2006, sixth in 2015 and seventh in 2018 were upgraded to summits. Over the 22 years since its establishment, the Forum has grown to become the most important framework for strengthening the China-Africa partnership at all levels, including the political, economic, cultural, and security fields.

The Belt and Road Initiative (BRI) which was established by China in 2013 to improve connectivity and cooperation on a transcontinental scale has become another important platform for China-Africa Cooperation. As of 2022, 52 countries in Africa and the African Union have signed Belt and Road Initiative (BRI) cooperation agreements with China[1], the largest number of countries from any continent in the world.

Despite this, FOCAC has faced criticism and negative depiction about the overall meeting structure. Related criticism has also questioned the true nature of China’s involvement in Africa and asked whether it truly gives Africa a seat on the table. More recently, some analysis has been painting a picture of a weakening China-Africa relationship.

So, is FOCAC only a high-level closed-door talk among elites with no tangible results? And is China losing interest in Africa and cutting back on its financial commitments?

That’s what this report aims to answer, in two parts. The first part explains the path and results of FOCAC meetings, through a comparison of the 2000 summit held in Beijing to the latest in 2021, held in Dakar. The second part explores the economic achievements and challenges faced in the relationship. The report concludes with outlooks for future development, in particular on how China and Africa will further strengthen their mutual cooperation with the ultimate goal of improving lives of both peoples.

(I) The First Ministerial Conference in 2000

Chapter 1: Evolution of the China-Africa Policy Mechanism

There is no doubt that China and African countries had been working together prior to 2000. African leaders regularly visited China, and vice versa, to achieve both diplomatic and economic aims. Chinese leaders were engaged with the region. For example, in 1996, the late President Jiang Zemin gave a landmark speech at the Organization for African Unity in Addis Ababa – which in 2002 became the African Union.

However, it was in 2000, as a response to a request from African partners, that the FOCAC mechanism was born. The idea for the mechanism took into account lessons from other existing “Africa-Plus-One” forums, such as those organized by France since 1973 and Japan since 1992, which provided regular opportunities to reflect on existing cooperation and seek new

opportunities. The FOCAC however, had its own unique elements – for example being held regularly every three years, and remaining primarily a government-to-government forum, with few observers, although numerous side events did and still do take place.

Since 2000, seven successful FOCAC events have been held. The regularity of the event plus high-level engagement gave the mechanism more leeway to be ambitious and lead to unprecedented outcomes for the cooperation.

For instance, the 2006 Beijing summit resulted in the establishment of the China-Africa Development Fund (CADFund) – a key Development Finance Institution (DFI) focused on investing equity into Chinese companies aiming to operate in Africa. By 2018, the fund had invested in over 90 projects in 36 African countries.

In 2014, China invested USD 2 billion into a 10-year joint fund with the African Development Bank (AfDB), a direct result of increasing concessional financing that African countries had encouraged China to avail.

In 2011, the African Union became a full, permanent member of FOCAC, and as a result reciprocal representative offices were set up in 2015 in Addis and in 2018 in Beijing.

And, at the Johannesburg Summit of the Forum on China-Africa Cooperation in December 2015, which took place soon after Africa’s adoption of its long-term development blueprint and master plan Agenda 2063, South African President Jacob Zuma, 49 other African Heads of State and government and Chinese President Xi Jinping announced the upgrading from a “new type of China-Africa strategic partnership” to a “comprehensive strategic cooperative partnership”.

At this summit, China-Africa Fund for Industrial Capacity Cooperation (CAFIC) was established with an initial contribution of USD 10 billion and approved 17 investment projects within three years.

The actions from FOCAC were not all about finance. Trade was a major agenda too. Recognizing that insufficient progress had been made on closing Africa’s trade deficits with China, due to the 2018 Summit, held in Beijing, the first China-Africa Economic and Trade Expo was held in Changsha, Hunan Province where a total of 81 cooperative agreements were signed, worth over USD 20 billion. The 2021 edition saw 135 cooperation projects with a total value of USD 22.9 billion signed.

Another important result of the same summit was the Free Trade Agreement between China and Mauritius in October 2019, a first of its kind between China and an African country.

Overall, over the 22 years since its establishment, the Forum has grown to become the most important framework for strengthening the China-Africa partnership at all levels, including the political, economic, cultural, and security fields. And while bilateral meetings and engagement remain crucial, FOCAC is the key mode that African governments collectively advocate for improved outcomes in their relationship with China, and vice versa.

However, in 2020, the COVID-19 pandemic hit the world and threatened to interrupt FOCAC and many of its established mechanisms. But did it?

(II) The Dakar 8th Ministerial Conference in 2021: Nine Programs and Cooperation Vision 2035

In 2021, addressing the challenges posed by COVID-19, the Heads of Delegation of 53 African countries and the Heads of Delegation of China gathered in hybrid form under the co-chairpersonship of Senegal’s President Macky Sall and Chinese President Xi Jinping for the Eighth FOCAC Conference in Dakar. The conference adopted an unprecedented 4 agreed documents – the Dakar Declaration, the Dakar Action Plan (2022-2024), Declaration on China-Africa Cooperation on Combating Climate Change, and China-Africa Cooperation Vision 2035. The documents continued to make references to the ten-year frameworks and 15 flagship projects of the African Union’s Agenda 2063, including the newly operational African Continental Free Trade Area (AfCFTA), thus attesting China’s continued commitment to Africa’s development plans.

At the conference, Chinese President Xi Jinping proposed Nine Programs covering medical and health, poverty reduction and agricultural development, trade promotion, investment promotion, digital innovation, green development, capacity building, cultural and people-to-people exchanges, and peace and security. One of these nine programs contained specific plans geared to support Africa’s economic growth and sustainability. For example, in a bid to reach USD 300 billion in total imports from Africa in the next three years, China offered to further increase the scope of products enjoying zero-tariff treatment for the least developed countries, and build in China a pioneering zone for in-depth China-Africa trade and economic cooperation and a China-Africa industrial park for Belt and Road cooperation. Further, to spur more private investments, China committed to encourage its businesses to invest no less than USD 10 billion in Africa in the next three years and establish a platform for China-Africa private investment promotion. China also offered to undertake 10 industrialization and employment promotion projects for Africa, provide credit facilities of USD 10 billion to African financial institutions, in support of the development of African SMEs.

The nine programs will also be an important contribution to Africa’s digital transformation and green development plans. For instance, both sides will work together to expand e-commerce cooperation and hold online shopping events and e-commerce promotion activities for quality African products and tourism. Furthermore, as reiterated in the Climate Change declaration, China pledged to undertake a series of green development, environmental protection and climate action projects for Africa, including building centres of excellence on low-carbon development and climate change adaptation. China also pledged not to finance coal plants in African countries, seen as a key test of China’s commitment to global environmental sustainability.

The China-Africa Cooperation Vision 2035 was also crucial as a mid- to long-term cooperation plan, recognizing that in some cases, for example for private sector investment, it is important to give long-term policy signals and set out more long-term goals such as USD 60 billion investment by 2035, etc. The Vision 2035 confirmed the commitment of all parties to ongoing and increased mutual cooperation.

The significance and the opportunities provided by a collaborative platform such as the Forum of China-Africa Cooperation cannot be overstated. Both Chinese and African sides worked hard to align FOCAC and BRI with Africa’s own development strategies including Agenda 2063 and the AfCFTA, recognizing that a deeper BRI and AfCFTA cooperation between China and African countries could play an important part in building a more prosperous African continent.

But have these forums led to real changes on the ground? Has China only been interested in resources? The next part turns to these questions and more.

Chapter 2: Achievements

Following the first Beijing Summit, China’s investment in Africa grew rapidly in scale and scope. China-Africa trade volumes surpassed USD 100 billion for the first time in 2008 and surpassed USD 200 billion in 2019. In 2009, China became Africa’s largest bilateral trading partner and has since maintained this status[1]. In 2021, total Chinese Foreign Direct Investment (FDI) in Africa reached USD 44 billion, growing by 100-fold compared with 20 years ago. China became Africa’s fourth largest investor in terms of the FDI stock.

(I) Trade

What is the current picture of China-Africa trade?

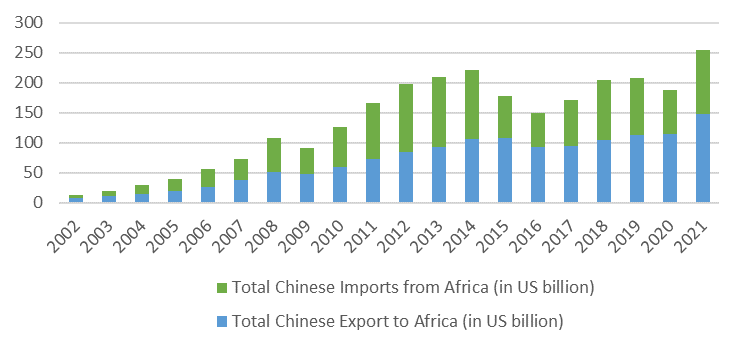

Over the past two decades, China-Africa trade has risen rapidly. China has been Africa’s top trading partner for thirteen years running. The total trade volume between China and Africa in 2021 (USD 254.2 billion) is about four times that between the United States and Africa (USD 64.3 billion). China-Africa trade has grown twenty-fold, from USD 12.3 billion in 2002 to USD 254.2 billion in 2021 (see Figure 1). Although the COVID-19 pandemic slightly affected trade relations, reducing trade by nearly 10%, recovery has been strong. 2021 witnessed a record high of bilateral trade, a 35% rise above the 2020 figure.

Figure 1: China-Africa Trade between 2002-2021 (in USD billion)

Source: China’s National Bureau of Statistics

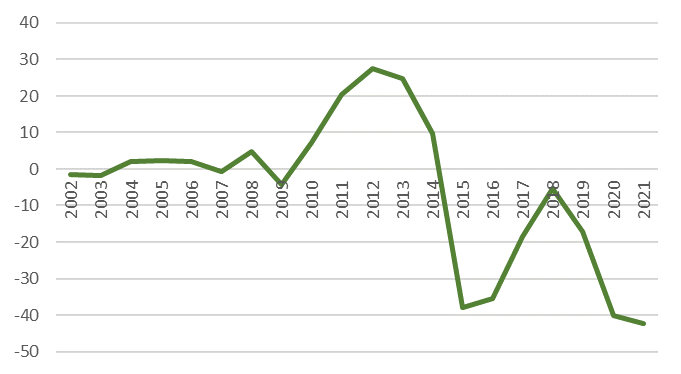

2006, 2008, and particularly 2010–2014, Africa experienced trade surpluses with China (African exports to China exceeded imports from China). The greatest surplus, USD 27 billion, was recorded in 2012. Since 2015, Africa has experienced an annual trade deficit with China of USD 28 billion on average.

Figure 2: Africa’s trade balance with China between 2002-2021

Source: China’s National Bureau of Statistics

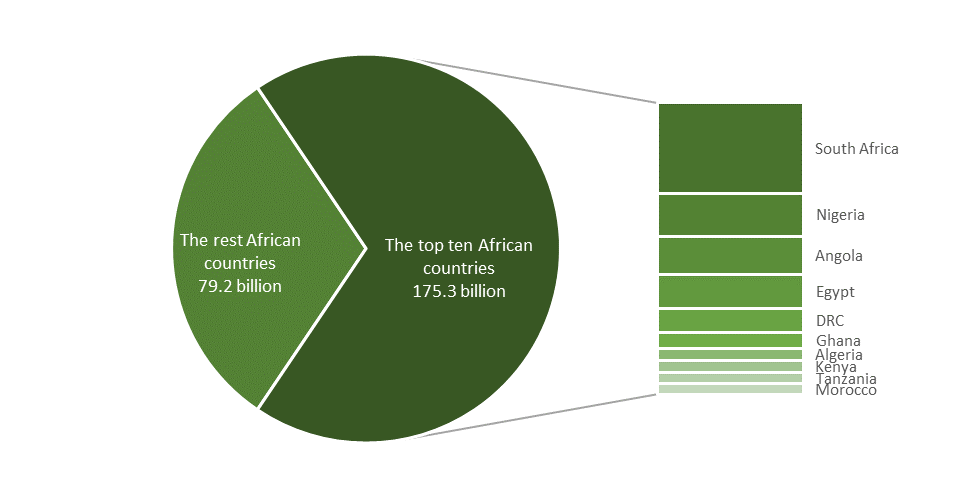

Figure 3: China-Africa Trade by top 10 African countries in 2021 (in USD billion)

Source: China’s National Bureau of Statistics

What are the top trading products?

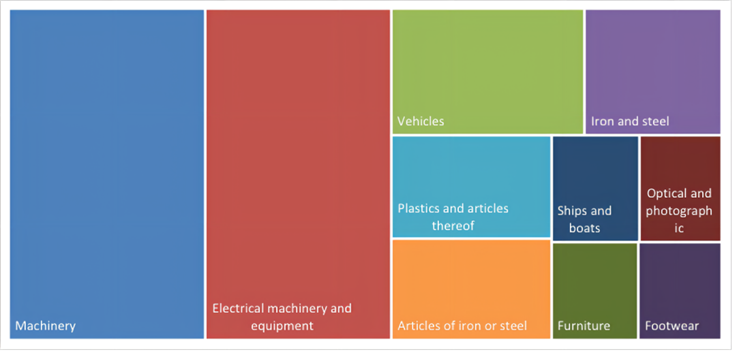

In 2021, China’s exports to Africa totaled USD 148.3 billion, an increase of 29.9% from the previous year. Africa’s imports from China have focused on manufactured goods, such as electrical equipment, machinery, vehicles, clothing and appliances. This is largely attributable to Africa’s expanding consumer markets as well as China’s development as a global industrial leader. Machines, electrical equipment, automobiles, iron, and plastics continue to be the top Chinese imports in 2021 (see Figure 4). The top three nations purchasing Chinese goods are Nigeria, South Africa, and Egypt.

Figure 4: Africa’s top 10 imports from China in 2021Source: Trade Map Database

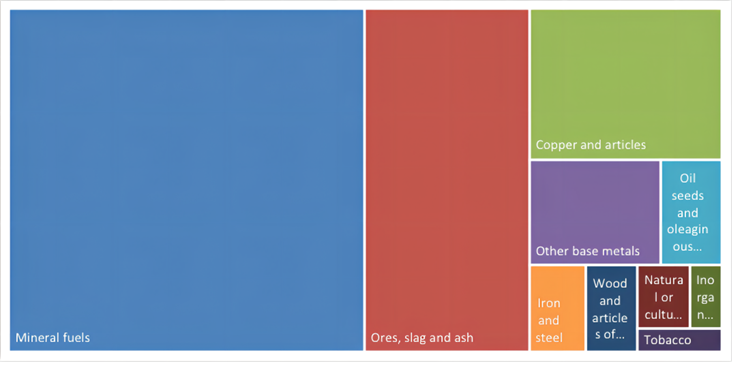

The total volume of China’s imports from Africa also experienced an expansion, rising 43.7% to USD 105.9 billion in 2021. In addition to raw materials like oil, precious minerals, and metals, China is progressively increasing imports of agricultural products and manufactured items from Africa (Figure 5). Top agriculture exports to China in 2021 include oil seeds and oleaginous fruits, animal or vegetable fats, edible fruits and nuts, tobacco and cotton. South Africa, Angola, the Democratic Republic of the Congo, the Republic of the Congo and Zambia exported the most to China in 2021. South Africa and Angola make up about half of the total exports from Africa.

Figure 5: Africa’s top 10 exports to China in 2021Source: Trade Map Database

Where is this trade relationship going?

In sum, under the framework of FOCAC and BRI, China-Africa trade has made a remarkable increase in the past two decades and the growth will continue with stronger momentum. Yet, challenges remain to impede the improvement of China-Africa trade relations, including the trade deficit for Africa, the heavy import concentration on raw materials, inadequate value addition in Africa, and limited trade relations with smaller African economies. In response to these challenges, China, with many African countries, has been making efforts to reduce the trade surplus gap with Africa, diversifying categories of importing products, encouraging value addition and expanding trade partners in recent years. Various measures have been proposed in the last FOCAC meetings to address these issues. For instance, at the FOCAC Summit in 2018, China announced giving free taxation to 97% of products from Least Developed Countries (LDCs) in Africa and this number increased to 98% at FOCAC 8. 33 African countries have enjoyed 97% duty-free export to China since 2018 and 18 African countries have 98% duty-free access (as of 1 Dec 202) 2022). Efforts were strengthened at FOCAC 8 in 2021 where China committed to increase imports from Africa to USD 300 billion in the next three years.

If this is achieved, China will become Africa’s biggest export destination. Furthermore, China also announced the establishment of ‘green lanes’ for African agricultural exports to China, expansion of the import of quality specialty agri-food products from Africa, and the speeding up of the inspection and quarantine procedures. Results from those efforts have started to emerge. After China opening the market for fresh avocados from Kenya in March 2022, the first batch of 45 tons of fresh Kenyan avocados arrived in China in August 2022. By November 2022, Kenya had exported 1,700 tons of avocado to China. Following Kenya, Tanzania’s avocado was granted access to the Chinese market in November this year. Other agricultural products that have already benefited from ‘green lanes’ include citrus from South Africa, sesame from Tanzania and dry chilli from Rwanda .As part of the effort to promote value-added products, creative marketing approaches such as e-commerce and live-streaming are applied. In April and May 2022, the Chinese Ministry of Commerce, joined by major e-commerce platforms in China, hosted the 4th Quality African Products Online Shopping Festival. More than 200 products from over 20 African countries were featured and the sales volumes for Kenyan black tea and Ethiopian coffee grew 409% and 143.1% respectively. With this momentum, it is expected that China-Africa trade relations will grow bigger and stronger.

(II) Investment

In addition to being Africa’s largest trading partner, China has also been a leading source of FDI in Africa. The McKinsey report published in 2017 suggested that Chinese investment had generated several million jobs in Africa. In addition to job creation, FDI plays an important role in Africa’s industrial development and transformation. It serves as an important channel for transferring technologies, skills, management methods and innovations between countries. Being a critical source of private financing, FDI also fosters international trade by providing access to international market networks. FDI in various sectors promotes the development of supply chains. For instance, investments in the construction industry contribute to the improvement of logistics and connectivity and in the agriculture sectors it increases productivity and reduces food insecurity. Ultimately, FDI can be a vehicle for economic development and transformation.

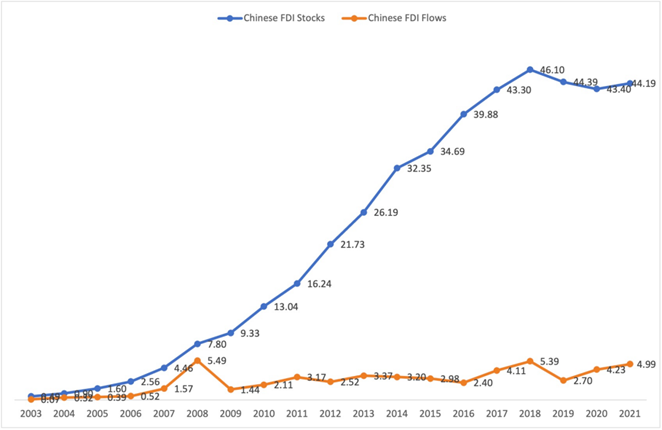

The overall trend of Chinese FDI annual flows to Africa in the past two decades has been consistently positive, although somewhat volatile as shown in Figure 6. Since 2003, annual flows of Chinese investment into Africa have grown more than sixty-fold, from a mere USD 74.8 million in 2003 to USD 5.0 billion in 2021. Additionally, since 2013, Chinese FDI flows to Africa have eclipsed those of the United States, according to data from the China Africa Research Initiative at Johns Hopkins University. In terms of the FDI stock, over a span of 17 years, Chinese FDI stocks in Africa increased almost 100-fold, from USD 0.49 billion in 2003 to USD 44.2 billion in 2021. It peaked in 2018 at USD 46.1 billion. China is now the continent’s fourth-largest investor.

Figure 6: Chinese FDI Stock in and flows to Africa between 2003-2021 (in USD billion)

Source: The Statistical Bulletin of China’s Outward Foreign Direct Investment

The top five African destinations for Chinese non-financial FDI as of 2020 were South Africa, the Democratic Republic of the Congo, Zambia, Ethiopia and Angola. Chinese investment in these countries covers a wide range of activities, including construction, mining, manufacturing, financial services, leasing and business services, and scientific research and technologies services. The largest FDI inwards sector, the construction industry accounted for 15.2 billion USD of China’s total FDI stock in 2020, about a third. while mining held around a fifth. Manufacturing is the third largest industry that draws a lot of Chinese investment (14.1%), particularly in African nations with pro-active industrial policies or sizable domestic markets. The following three sectors have seen a positive effect of Chinese FDI on economic growth and industrial development in Africa

Infrastructure

Investment in construction sector is meaningful for infrastructure improvement which is a key component in realizing economic development and transformation in Africa. According to the Investment in construction sector is meaningful for infrastructure improvement which is a key component in realizing economic development and transformation in Africa. According to the African Development Bank, the infrastructure finance shortfall on the continent ranges from USD 68 to USD 108 billion annually.[1] Infrastructure is crucial to all economic activities as trade requires good road and railway systems connecting producers with consumers while manufacturing requires infrastructure facilities such as water and power systems to sustain production. With the African Continental Free Trade Area (AfCFTA) coming into effect in 2021, infrastructure investment will play an even more critical role for the post-COVID-19 recovery and the AU’s 2063 Agenda. China has been a steadfast partner in infrastructure development and the construction industry has been the main recipient of Chinese FDI.

The African Development Bank also notes that the continent’s energy infrastructure has the greatest need for investment. In contrast to other emerging countries where access to electricity is between 70% and 90%, only 30% of Africans have it, according to their research.[2] In addition, Africa is faced with a stark digital infrastructure deficit. European Investment Bank estimates that about 900 million Africans still do not have access to the internet, while for those who do, connectivity costs are still generally expensive and bandwidth is severely constrained in many places.C In order to cover the financial needs in these sectors, Chinese investment will be an important source for private foreign financing.

Manufacturing

The manufacturing industry has traditionally played a crucial part in the economic development of developing nations. It drives productivity growth and innovation, generates employment, increases exports and promotes technology transfers. In the past decade, a number of Chinese manufacturing companies have transferred activities to Africa, particularly in the light manufacturing sector. A 2017 study by McKinsey revealed that more than 10,000 Chinese-owned companies operating in Africa, accounting for around 12% of Africa’s industrial production. Through the potential for job creation and exports, Chinese FDI in Africa’s manufacturing sector can have a positive impact on the continent’s economy and assist Africa to reach its aim of becoming the world’s manufacturing hub by 2063. A fine example is the China-Egypt TEDA Suez Economic and Trade Cooperation Zone (TEDA Suez). It is an industrial park built by Chinese enterprises that currently hosts over 100 enterprises. Infrastructure investment like TEDA Suez unlocks the manufacturing potential and generates positive impacts on job creation and local industrialization. Other well-known examples of manufacturing investments include Huajian Group in Ethiopia and Humanwell Healthcare Group in Mali and Ethiopia.

Green energy

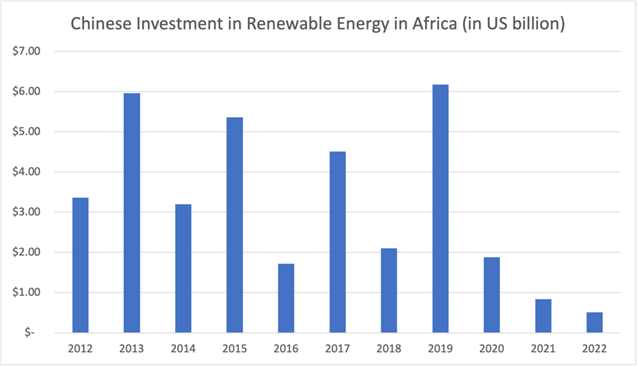

Chinese investments play important roles in financing Africa’s renewable energy (including hydropower, solar PV, wind, and geothermal). According to the China Global Investment tracker from the American Enterprise Institute (AEI), as shown in Figure 7, Chinese investment in renewable energy in Africa has increased from USD 3.36 billion in 2012 to a record high of USD 6.18 billion in 2019, although it has fluctuated over this period. However, the investment in renewable energy has decreased significantly since 2019 and in 2021 the figure valued at USD 0.84 billion, accounting for 1.9% of the total Chinese FDI stocks in Africa.

Figure 7: Chinese investment in Renewable Energy in Africa between 2012-2022 (in USD billion)

Source: China Global Investment Tracker, American Enterprise Institute

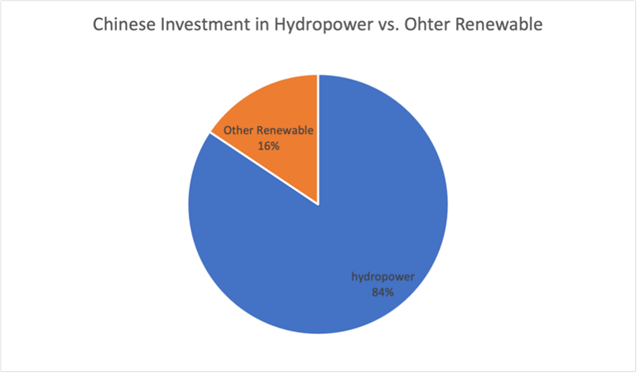

As shown in the Figure 8 below, over the past decade, Chinese renewable energy investment in Africa has concentrated in hydropower. Although the investment has also been in the solar and wind sectors, the share is relatively small.

Figure 8: Chinese investment in Hydropower vs. Other Renewable Source: China Global Investment Tracker, American Enterprise Institute

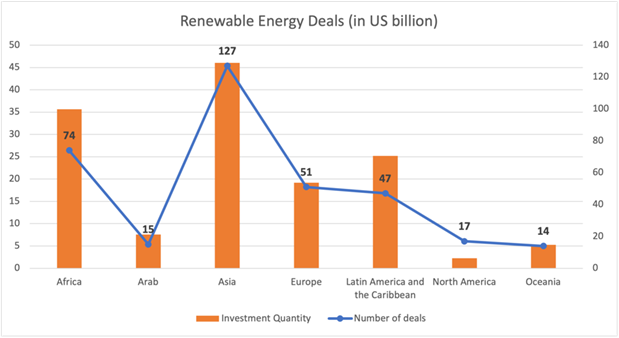

Looking at the regional distribution in Figure 9, Africa is the second largest destination for Chinese investments in renewable energy, in terms of value and quantity of project, following the Asia.

Figure 9: Chinese investment in renewable energy deals by regions

What are other trends in China-Africa investment cooperation?

In recent years, responding to the call of FOCAC as well as the demand for quality agro-products from Africa, the agriculture sector in Africa is receiving increasing interest from Chinese investors. Agriculture is the economic pillar of many African countries, accounting for 23% of the total GDP and providing 60% of employment in sub-Saharan Africa.

It is not only important to economic growth but also critical to Africa’s food security. Although current Chinese FDI into Africa’s agriculture is rather limited, the high potential of the industry as well as the surging bilateral agriculture trade are attracting more and more Chinese investors to invest in Africa. Chinese investment projects, such as sugar in Mali, rice in Mozambique, Madagascar and Nigeria, cotton in Malawi and Zambia, and agro-processing in Ethiopia, Kenya and Tanzania are all contributing to strengthened food security in Africa.

Chapter 3: Future Development

Enhancing economic ties in traditional areas of cooperation such as trade and investment continues to be a priority. To realize the target of increasing trade with Africa, China will diversify import products from Africa and improve trade facilitation with Africa. More specifically, China also increases imports through ‘green lanes’ for agricultural products, accelerates inspection and quarantine, offers tariff preferences for LDCs, and innovates marketing tools like live streaming. If the target is achieved, China will be Africa’s biggest trade partner for both imports and exports. On investment, China pledges to invest another USD 60 billion in Africa by 2035 in industries that support African agriculture, infrastructure, manufacturing capacity, environmental protection, digital economy, blue economy etc. Besides, the Chinese side will encourage technology transfer and the employment of innovative methods such as Build-Operate-Transfer (BOT) and Public-Private Partnerships (PPP).

The establishment of AfCFTA will contribute to closer economic ties between China and Africa. China and the Secretariat of AfCFTA will form an expert group to foster collaboration and knowledge exchange in areas including intellectual property rights, customs cooperation, digital trade, and competition policy. While free trade under AfCFTA takes hold, it will produce new trading and investment opportunities in various sectors for Chinese business and it will provide an impetus for China-Africa economic cooperation.

Climate change is an increasingly crucial area of engagement between China and Africa. FOCAC 8 adopted an important blueprint document on climate change – the Declaration on China-Africa Cooperation on Combating Climate Change. This document acknowledges the urgency of climate change and the imperative of joint actions to tackle it. The two sides will strengthen strategic cooperation in multiple areas including clean energy, climate technologies, agriculture, forest, ocean, low-carbon infrastructure, disaster prevention and mitigation, etc. One of the practical measures for collaboration is to fund and invest in gas-to-power and green energy development projects. Another key development is the establishment of the ‘Global Development Initiative’ (GDI) which joins FOCAC and BRI for stronger international cooperation for development. Proposed by President Xi Jinping at the General Debate of the 76th United Nations General Assembly in September 2021, GDI was established to help all nations, especially developing countries address challenges caused by COVID-19 pandemic and to assist the attainment of the Sustainable Development Goals (SDGs). To achieve the two goals, it will focus on cooperation on eight priority areas including poverty alleviation, food security, COVID-19 and vaccines, development financing, climate change, industrialization, digital economy, and connectivity. Africa is an important partner of China to achieve this initiative. The African Union and 53 African nations have shown strong support for GDI. The Dakar Declaration of the Eighth Ministerial Conference of FOCAC and the Dakar Action Plan both stated that African countries welcome and support the GDI, and

that GDI will dock with the AU’s Agenda 2063.

Under the framework of FOCAC, BRI and GDI, guided by Vision 2035, China and Africa will further strengthen their cooperation in infrastructure development, economic and commercial exchanges, agriculture and food security, climate change, people exchanges, security and health, with the goal of realizing AU’s Agenda 2063 and improving lives of both peoples.

The next FOCAC is in 2024 – during and beyond that period, African governments and institutions need to engage proactively with Chinese stakeholders to implement the commitments made at FOCAC, BRI and GDI.

CGTN Think Tank was launched to encourage the exchange of ideas and views as well as promote dialogues among members from Chinese and foreign think tanks on global issues and topics so as to provide accurate information, insightful analysis and rational debate for CGTN viewers and users worldwide.